Advancing relations with Australia’s ASEAN neighbours has long been a logical economic, security and broader political strategy of successive Australian governments. The current statement of Australia’s economic strategy in Southeast Asia is contained in the report, Invested: Australia’s Southeast Asia Economic Strategy to 2040, prepared under the leadership of Nicholas Moore AO, appointed Special Envoy for Southeast Asia and former CEO of the Macquarie Group. The report was released in September 2023. Its overarching objective is greater two-way trade and investment between Australia and Southeast Asia.

Of the 10 key industry sectors the report identifies and examines for opportunities, agriculture and food may be the one of most obvious relevance to rural and regional Australia, though doubtless there is scope for businesses within the others too, as described by the report: resources; green energy transition; infrastructure; education and skills; visitor economy; healthcare, digital economy; professional and financial services; and the creative industries.

Southeast Asia’s strong economic growth, its large and increasing market, including for quality protein and premium products, its need for food security, sustainable development and the scope for technology exchange and collaboration, including in value-adding to raw materials, these are all highlighted as reasons Australian agriculture should look to the region for trade and investment opportunities.

At a time when Australian agriculture comes under regular scrutiny for its environmental impact, with the industry often required to defend its sustainability and demonstrate improvements in practices, one might hope and expect that advances in sustainable farming achieved by Australian businesses in Southeast Asia, especially if with government support, would sound in sustainability benefits for the Australian industry generally also.

Bygen

Testimony to the potential presented by Southeast Asia is the steady progress of innovative Australia agtech company Bygen, both domestically and in the region, in this case Vietnam.

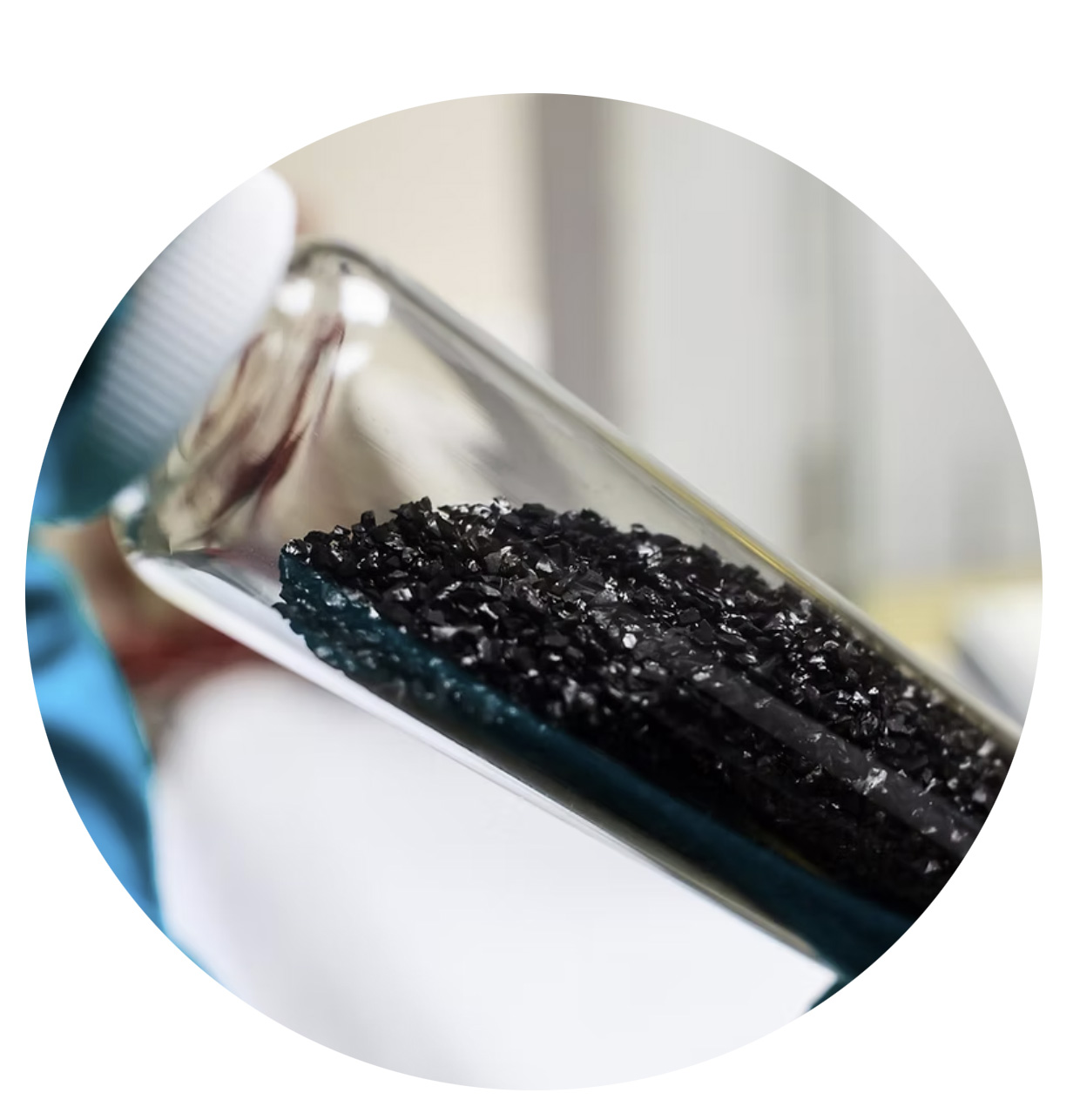

Bygen is a Melbourne-based manufacturer producing granular and powdered activated carbon products. They use high-carbon content nut shells (almonds, walnuts, hazelnuts) and sustainable forestry materials which are then processed using a proprietary low-temperature technique to significantly reduce energy use and carbon emissions compared to traditional activated carbon production methods.

Bygen’s activated carbon is an export-ready technology and now helping to the expand the local carbon markets in Vietnam and meet their emissions-reduction targets.

Australian Rural & Regional News found out more from

Cameron Griffiths, Bygen Chief Commercial Officer.

ARR.News: Where did the idea for Bygen come from? How did the business start?

CCO Bygen.

Cameron Griffiths: Bygen was founded as a spin-out from the University of Adelaide, following the initial research into Low-Temperature Activation (LTA) – a patented, world-first process for producing high-performance activated carbon from sustainable biomass instead of coal.

Traditional activated carbon manufacturing is energy-intensive, slow, and costly. It typically relies on coal as the raw material, requires activation temperatures near 1000°C, consumes large amounts of steam and water, and emits up to 18 tonnes of CO2 for every tonne of activated carbon produced.

We saw a clear opportunity to re-engineer the process from the ground up through using recycled process gases instead of fossil fuels. This approach reduces production costs by up to 60 per cent, cuts water use by 50 per cent, and enables the use of abundant agricultural and forestry residues, such as nut shells or sawdust, rather than mined coal.

The result is a process that not only produces high-quality, tailored activated carbon but also sequesters carbon, delivering a product that is cleaner, smarter, and more sustainable without compromise.

ARR.News: Bygen activated carbon products. How do these differ from traditional biochar? Do the products capture/ store carbon? Is the carbon released on usage/saturation or permanently stored? Are the emissions reductions from reduced energy use or from carbon sequestration and storage?

Cameron Griffiths: Biochar is the precursor for activated carbon production. It is synonymous with traditional charcoal and is made at high temperatures in an air free environment. Traditionally, this charcoal is then shipped to specialist activation facilities where it is turned into activated carbon using external fuel (fossil based) as the heat source.

There is interest now in using that biochar/charcoal for agricultural purposes, due to its benefits for soil enhancement, which stem from its high carbon content and ability to retain moisture.

However, activating this charcoal develops the porosity and surface area that makes activated carbon useful as a filtration material and is generally considered a more specialist technology. It is in this activation method that our IP stands out in the market, due to its ability to cut production costs significantly.

The reason that our activated carbon is carbon-negative is similar to the story with biochar though. Short-term growth biomass that takes CO2 out of the air when it grows then stores this carbon in its structure. Rather than let this decompose back to CO2 (a carbon-neutral process, not taking into account methane emissions), by converting this carbon into a highly-stable form that does not degrade for centuries or even millenia, through a technology like ours, results in a net carbon reduction.

So with our technology, we are both permanently sequestering carbon in our end product, as well as eliminating the external fossil fuel based heat that is associated with conventional activated carbon production, which combine to be an extremely effective method of avoiding carbon based emissions.

ARR.News: What are the primary uses of it in Australia now? Is there potential for wider use here? How about cleaning floodwater for drinking in a time of a shortage of potable water, is that possible/ realistic?

Cameron Griffiths: In Australia, Bygen supplies activated carbon for drinking water treatment, wastewater treatment, PFAS removal, food and beverage decolourisation, gold recovery and gas/vapour treatment.

Yes – there is strong potential for wider use. Activated carbon is a standard stage in drinking-water treatment (PAC or GAC) in Australia and globally, and it is widely used for PFAS control; utility examples and guidance back this up. In emergency contexts (e.g., floods), mobile or temporary GAC systems are routinely deployed as a polishing step alongside clarification/disinfection.

ARR.News: From where do you source the biomass feedstocks for your products? How do you see the demand for these ingredients increasing? Are the primary producers and other sources selling you materials that are otherwise of no value, or are there competing uses for this biomass (e.g. biofuel, biochar)? What do you mean by sustainable forestry waste?

Cameron Griffiths: We typically partner with producers of large volumes of biomass by-products (nut shells, woody residues) to help convert this material into high-value activated carbon.

Competition for these materials really depends on what it is and where it is located. In Australia, for example, the traditional disposal route for nut shells is cattle feed. While not of particularly high-value, it does offer a small return for the producers. However, this is very seasonal, and often there is no demand for this when we are not in a drought climate. Having a long-term off-take agreement in place can be a compelling proposition for many of these processors.

With forestry by-products, we have traditionally processed quite a wide-range of different kinds. From export grade wood chips (at the premium end) to lower value sawdust type materials. Each project is different, but often the economics of converting these materials to activated carbon is compelling.

Biofuels are often not a competitor for us as we often look for different types of feedstocks with differing properties. Biochar is sometimes an alternative pathway that we can come up against, but the higher value and well-established market of the activated carbon will typically hold its ground against it.

ARR.News: What are its primary uses in SE Asia now?

Cameron Griffiths: In Southeast Asia, our focus is on demonstrating the performance and scalability of our LTA technology across local biomass feedstocks.

Through our Vietnam pilot project, funded by the Net Zero Challenge, and the Malaysian partnership project, we are validating the LTA process using a range of local agricultural residues and industrial by-products. The Malaysian project focuses on adapting the technology to support high-value activated carbon production for applications such as water treatment, air purification, and other emerging markets across the region.

We are testing materials such as sugarcane bagasse, coffee hulls, cassava fibre, coconut husk and bamboo to evaluate their suitability for producing high-performance activated carbon. These trials target water and wastewater treatment, including PFAS and industrial contaminant removal, as well as air and vapour purification applications.

Our broader goal is to establish local production and supply partnerships across the region including in Malaysia and Vietnam, turning under-utilised biomass into premium activated carbon for water utilities, industry, and resource recovery applications. This not only supports cleaner water and air but also contributes to regional circular economy and decarbonisation goals.

ARR.News: What government support have you received, financially and otherwise?

Cameron Griffiths: We have been fortunate enough to previously receive an accelerating commercialisation grant that helped us in the early stages of growing the business. Most recently, we were awarded a CRC-P grant alongside RMIT and CSIRO to embark on a substantial research project related to developing tailored activated carbons for improved performance in PFAS adsorption applications. This project will also focus on building our domestic activated carbon regeneration capabilities, with a particular focus on water treatment applications.

ARR.News: Are you planning to expand production, in Australia or SE Asia?

Cameron Griffiths: In Australia, we are currently finalising the next locations for several new manufacturing sites. These will primarily use locally available nut shells and wood, which are abundant domestically.

In Southeast Asia, we are building on the momentum of our Vietnam pilot, funded through the Net Zero Challenge, which is testing local biomass such as sugarcane bagasse, coffee hulls and cassava fibre. Alongside Vietnam, we are also expanding in the Philippines and Malaysia where biomass availability and regional demand for sustainable filtration materials make ideal conditions for local production.

We’ll continue expanding strategically wherever there is strong feedstock availability, local partnerships, and demand for low-carbon activated carbon alignments ensuring Bygen remains a global leader in sustainable carbon production.

ARR.News: How do you see your business benefitting Australian primary producers, Australian industry and the Australian economy?

Cameron Griffiths: Our commercialisation process actually cuts across quite a wide-range of these sectors. With primary producers, we are obviously interested in developing our technology alongside them, which helps us secure feedstock to scale our own production, while at the same time assisting them with adding value to their by-products. This also creates local jobs in remote regions.

On a wider-scale, commercialising university research is a really vital tool in helping boost Australia’s productivity and return on taxpayer investments into R&D. This is something that we are passionate about and feel Australia’s world-class university research capabilities is not as effective as it could be in translating to commercial success. There are many reasons for this, but it can be done, and we hope that we can help serve as an example of this (alongside many of our peers who come from similar backgrounds).

ARR.News: What advice would you give to Australian producers and businesses wanting to add value to raw materials for the export market?

Cameron Griffiths: To prove your sustainability advantage with data. Conducting a proper Life Cycle Assessment (LCA) under recognised ISO standards gives international buyers the confidence that environmental claims are measurable and credible.

Equally important is designing close to the resource, turning local agricultural or forestry by-products into high-value materials near their source. This keeps value creation in Australia, lowers transport emissions, and demonstrates real circular-economy thinking.

Running pilot projects with partners or utilities in key markets builds trust far faster than paperwork ever will.

Businesses should make use of programs like the Net Zero Challenge and other market-entry initiatives, which can open doors, validate technology, and connect you with the right regional stakeholders. Also check what support government agencies such as Austrade can provide, they have people on the ground and can provide valuable market insights and introductions.